Responsible investing

Our vision in Responsible Investment

Together with our clients, asset managers can help create a more sustainable world.

Together with our clients, asset managers can help create a more sustainable world.

We are creating responsible investment solutions to help our clients achieve their sustainability goals and fight against climate change.

The global shift towards sustainable investing means more opportunities.

The global shift towards sustainable investing means more opportunities.

We see a multi-decade investment opportunity where new technologies, business models, investment products, alongside ESG integration, will facilitate both wealth creation and sustainable outcomes in the long term.

The net-zero transition will give rise to new, valuable asset classes.

The net-zero transition will give rise to new, valuable asset classes.

Natural, human and social capital are the world’s most precious resources. We support their development into investible asset classes with the aim of directing capital towards the UN Sustainable Development Goals.

A sustainable world is fair and inclusive.

A sustainable world is fair and inclusive.

We are committed to helping our stakeholders prosper – our clients, shareholders, employees and the societies which we operate in, developing countries in particular. No one should be left behind in a just transition.

Engagement and stewardship are powerful tools of change.

Engagement and stewardship are powerful tools of change.

We hope to offer the best to our future generations by promoting positive behaviour throughout invested companies and advocating for a more sustainable financial system in collaboration with the industry.

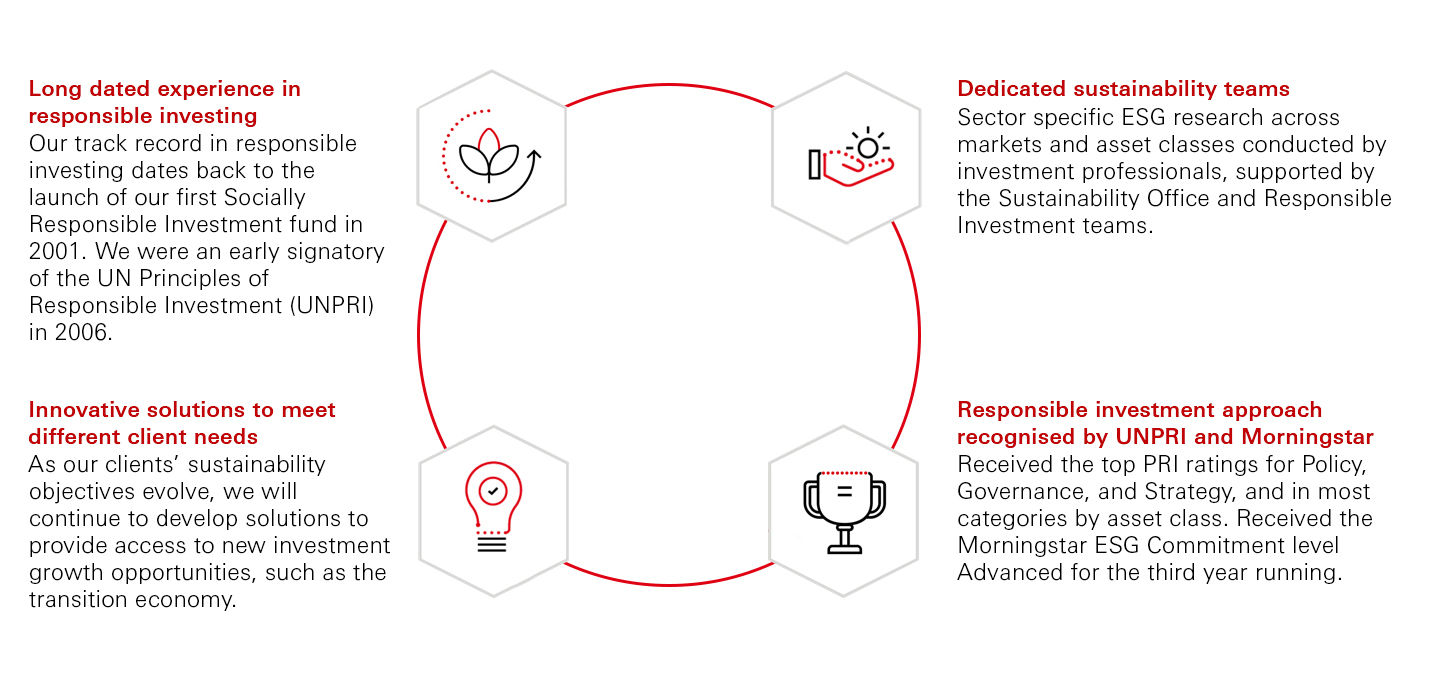

Why HSBC Asset Management?

Sources: Morningstar, PRI and HSBC Asset Management. For illustrative purposes only.

The score figures displayed in the document relate to the past and past scores should not be seen as an indication of future scores.

1. PRI signatories are required to report publicly on their responsible investment activities each year, based on which an Assessment Report is issued.

2. Out of 97 asset managers assessed by Morningstar, 25 earned a Morningstar ESG Commitment Level of Advanced in 2023.

© Copyright 2024 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

For further information visit our UK site