Global Investment Outlook 2023

And now to paying it back

Over the past 18 months the world has seen important successes for economies and investment markets, but the price tag for most assets now stands high.

2022 Investment Outlook - Xavier Baraton

We have titled our outlook ‘The Price of Success’. That success has been readily apparent amidst an economic recovery that is the fastest on record.

In the past 18 months the world has seen three important successes.

Three wins

Government policy response has been effective in supporting economic growth, innovation of vaccines, and new environmental initiatives. |

|

On the strength of that came the fastest economic recovery on record, with the world’s largest economies on track to fully recover the pre-covid growth path by mid-2022. |

|

Investment markets recovered quickly. |

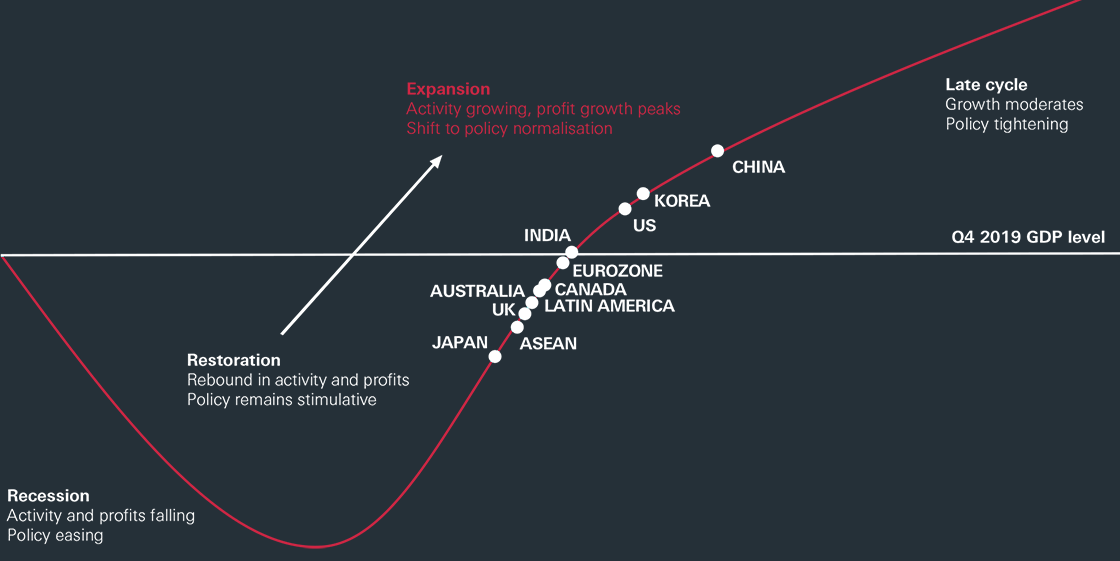

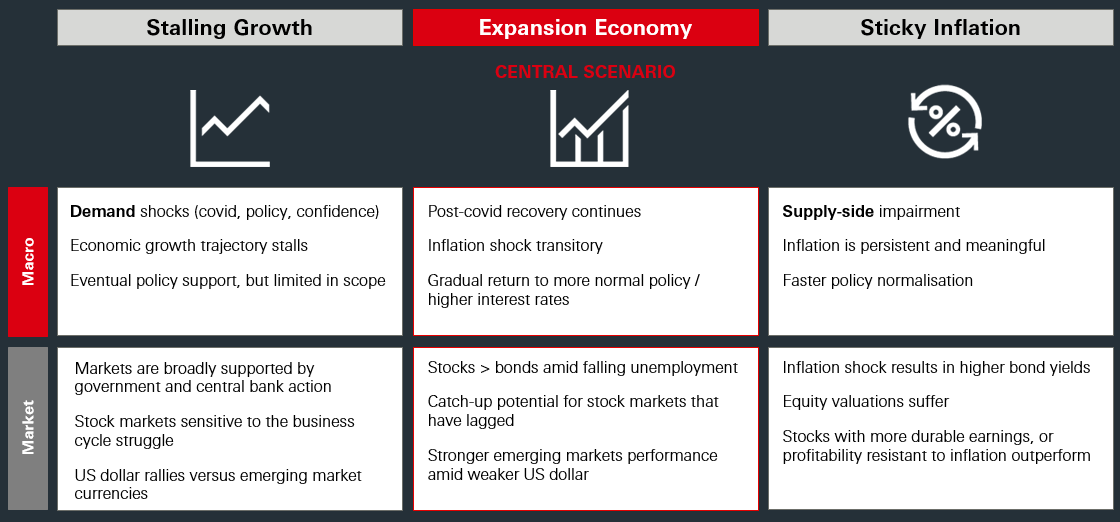

The global economy is now in a phase we have labelled as ‘the expansion economy’.

Typically, that means we are past peak growth, inflation picks up, and policy support falls away.

Source: HSBC Asset Management, November 2021. Any views expressed were held at the time of preparation and are subject to change without notice. While any forecast, projection or target where provided is indicative only and not guaranteed in any way. HSBC Asset Management accepts no liability for any failure to meet such forecast, projection or target. For illustrative purpose only.

More uncertainty

The biggest challenge for investors will be navigating the many economic and market uncertainties.

While our central scenario is reasonably positive, there are significant risks that something goes wrong on the demand or supply side. |

|

In terms of demand, a negative shock could come from a resurgence of covid impacting confidence and requiring new restrictions. Or, from the possibility of a harsher slowdown in China. |

|

The second risk scenario is that something goes wrong on the supply side, such as supply chains taking a lot longer to rebuild than we currently assume. |

Central scenario and risks

Positive central scenario, but beware of impacts should risks materialise.

Source: Bloomberg, HSBC Asset Management, November 2021. Any views expressed were held at the time of preparation and are subject to change without notice. While any forecast, projection or target where provided is indicative only and not guaranteed in any way. HSBC Asset Management accepts no liability for any failure to meet such forecast, projection or target. For illustrative purpose only.

What it means for portfolios

Uncertainty is exacerbated by higher valuations and lower margins-of-safety. We should expect more day to day fluctuations in markets.

|

Continue to hold stocks

Stocks typically beat bonds while labour markets are improving. |

|

Look at emerging markets, especially for bonds The case for owning renminbi bonds over global bonds seems strong. Likewise, the future return profile of Asian corporate bonds looks appealing. |

|

Protect against inflation Real assets such as property make sense to offer some protection against inflation, as do commodities. |

|

Explore alternative diversifiers Higher inflation has historically caused stocks and bonds to be more correlated. Alternative diversifiers should be explored today. |

|

Embrace sustainability Amidst the elevated uncertainty we face, investing in companies that have more sustainable business models and less exposure to risks should serve portfolios well. |

Read the full 2022 Investment Outlook

Investment expertise

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Past performance is not a reliable indicator of future performance. Any views and opinions expressed are subject to change without notice. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. We accept no liability for any failure to meet such forecast, projection or target. The information provided does not constitute any investment recommendation in the above mentioned sectors, asset classes, indices or currencies.